M&A strategies through 2027: How middle market companies plan for growth and exit

New survey data shows roughly half of middle market companies plan to pursue acquisitions by the end of 2025. But how are leaders timing mergers and acquisitions activity amid economic uncertainty, and what factors are most important as they prepare for growth and exit over the next three years?

KeyBank’s July 2025 Middle Market Sentiment Report offers insight from 762 owners and executives of middle market businesses across the United States with $10 million to $1 billion in annual revenue. The report outlines middle market leaders' plans for both buy-side and sell-side M&A activity, along with the challenges they anticipate throughout the process.

Key signals shaping M&A outlook through 2027

1. Buy-side momentum in middle market M&A remains solid

What middle market leaders are saying

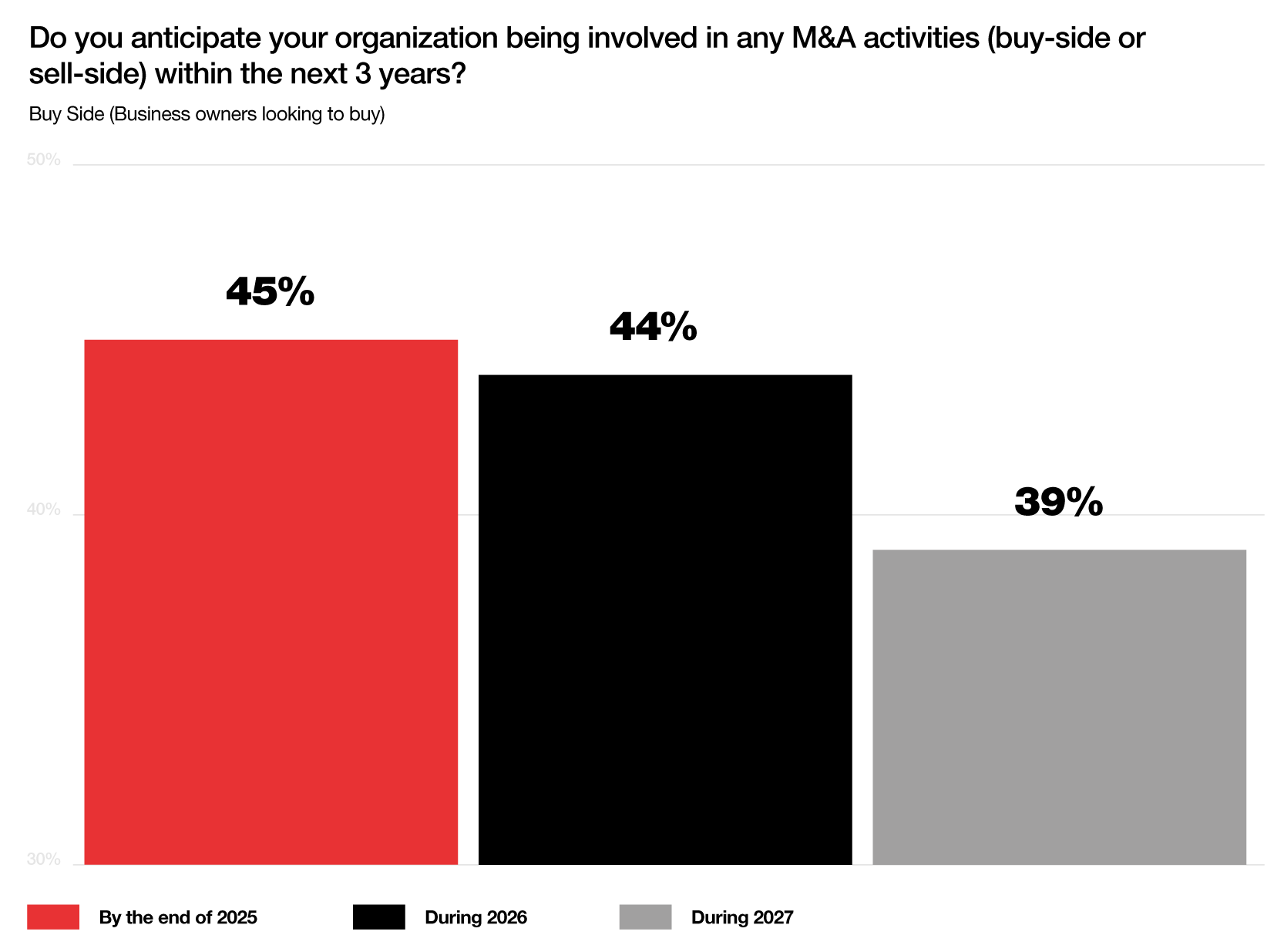

Buy-side interest in middle market M&A activity remains robust. Nearly half (45%) of middle market firms intend to pursue acquisitions by the end of 2025, with only a modest decline expected in 2026 (44%) and 2027 (39%).

GRAPH 1 – Do you anticipate your organization being involved in any M&A activities (buy-side or sell-side) within the next 3 years?

Buy Side (Business owners looking to buy)

By the end of 2025 45%

During 2026 44%

During 2027 39%

What it means for you

Over the next three years, middle market leaders considering buy-side activity will need to adopt a more deliberate and forward-looking approach. Refining target criteria now will allow organizations to respond quickly to attractive opportunities.

Strengthening relationships with potential sellers will be critical as competition for high-quality assets intensifies. Securing financing ahead of interest rate uncertainty can provide a significant advantage, both in terms of cost of capital and deal certainty.

2. Gradual rise in sell-side intent signals 2027 readiness

What middle market leaders are saying

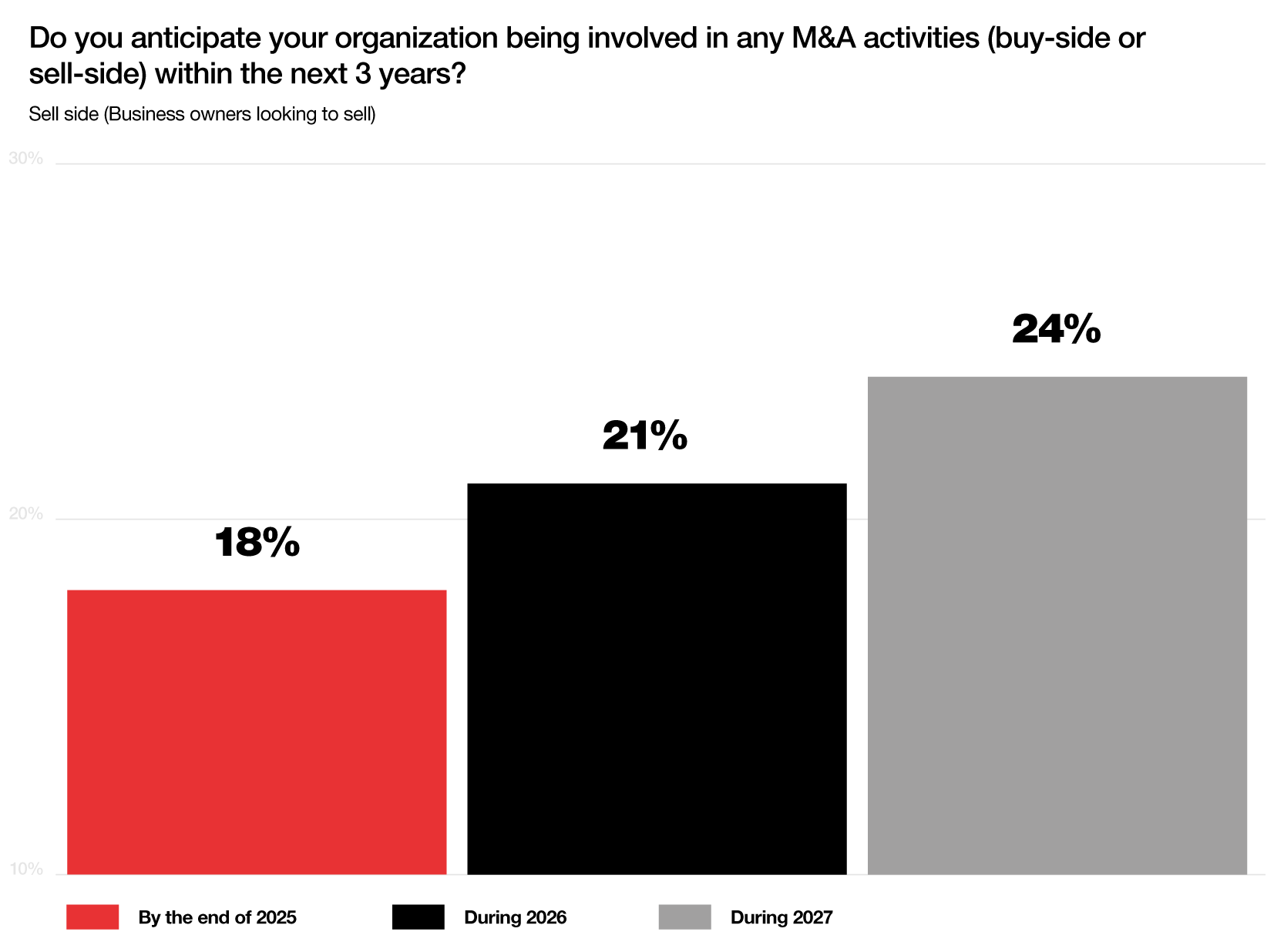

Sell-side M&A intent among middle market firms shows a gradual increase, growing from 18% in 2025 to 24% in 2027, suggesting that some business owners may be preparing assets for exit. However, many sellers remain cautious, citing concerns around market uncertainty and limited internal capacity to manage due diligence effectively.

GRAPH 2 – Do you anticipate your organization being involved in any M&A activities (buy-side or sell-side) within the next 3 years?

Sell Side (Business owners looking to sell)

By the end of 2025 18%

During 2026 21%

During 2027 24%

What it means for you

If you’re considering a sale in the next few years, this is the moment to start building momentum. Focus on strengthening your financials and addressing any operational gaps that could raise questions during diligence. Begin succession planning with care and clarity. These steps both improve valuation and give buyers confidence that your business is ready for what comes next.

3. Obstacles to navigating and executing M&A strategy

What middle market leaders are saying

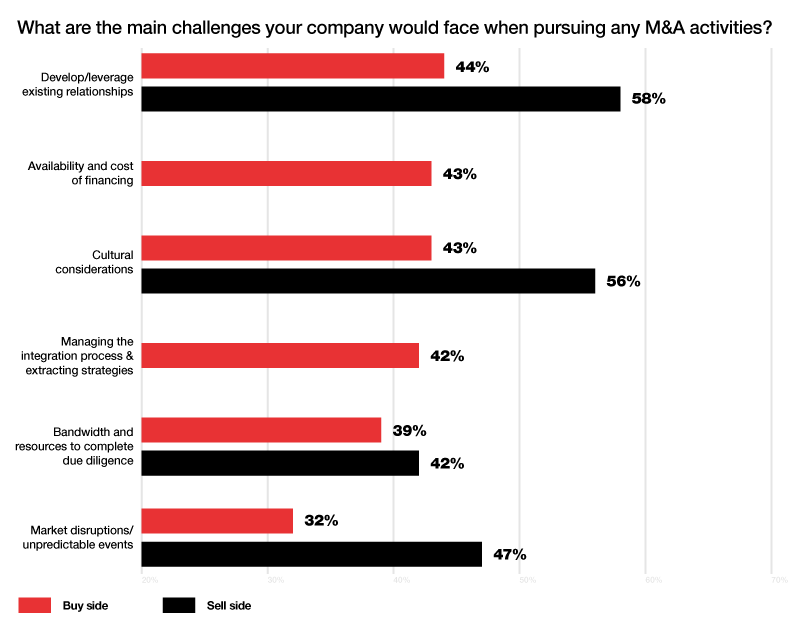

Buy-side concerns center on relationship development (44%), financing availability and cost (43%), cultural alignment (43%), and managing the integration process and extracting strategies (42%). On the sell side, the most pressing challenges include building or leveraging existing relationships (58%), cultural considerations (56%), and navigating market unpredictability (47%).

Middle market participants, both buyers and sellers, are awakening from a multi-year period of lower activity. With rates easing and more tariff clarity, the cost of capital will improve along with economic visibility — opening the door for strategic activity. At Key, we’re helping clients move decisively — whether they’re acquiring for scale or preparing for exit.

Randy Paine

President of KeyBanc Capital Markets & Key Institutional Bank

GRAPH 3 – What are the main challenges your company would face when pursuing any M&A activities?

Buy side

Develop/leverage existing relationships 44%

Availability and cost of financing 43%

Cultural considerations 43%

Managing the integration process & extracting strategies 42%

Bandwidth and resources to complete due diligence 39%

Market disruptions/unpredictable events 32%

Sell side

Develop/leverage existing relationships 58%

Cultural considerations 56%

Bandwidth and resources to complete due diligence 42%

Market disruptions/unpredictable events 47%

During 2026 21%

During 2027 24%

Improve cash flow management 72%

Focus on cost reduction 49%

Raising equity 47%

Increasing debt capacity 42%

What it means for you

If you're on the buy-side, success will come from staying flexible and focused. Look for financing structures that can adapt to changing conditions. Start conversations about cultural fit early, not after the deal is signed. And treat integration planning as a core part of the strategy.

If you're preparing to sell, relationships are your foundation. Build them with intention. Be ready to tell a clear and compelling story about your company’s value and future. And expect buyers to dig deep. That level of scrutiny is not a hurdle, but a chance to show you’re ready for what comes next.

Final thoughts

Middle market business leaders are planning for growth and potential exits by pursuing both buy-side and sell-side M&A activity over the next three years. Their primary challenges include securing financing, leveraging key relationships, ensuring cultural alignment, managing valuations, and navigating market uncertainty.

KeyBank’s middle market experts bring deep insight into the evolving business landscape and the unique challenges leaders face. We provide tailored financial solutions, customized guidance, and real-time support to help you structure capital, align strategy, and ensure cultural fit as you plan for growth or prepare for an exit over the next three years.

Is your strategy built for what's next? Get the full July 2025 Middle Market Sentiment Report to uncover what's driving today's middle market leaders.