AI trends in 2025: How leaders unlock efficiency in the middle market

Nearly 70% of middle market companies are investing in AI to boost productivity and enhance operations, according to recent survey data. Many leaders are taking a phased approach, starting with smaller technology investments to validate impact. They then reinvest based on proven returns, enabling companies to compete with larger rivals, address talent shortages, and build internal capabilities without stretching budgets.

KeyBank’s July 2025 Middle Market Sentiment Report clearly reveals what technology is getting funded, what leaders expect to gain from it, and what obstacles may get in the way. The analysis reflects input from 762 owners and executives at U.S. firms with $10 million–$1 billion in annual revenue.

Top priorities fueling AI strategy in 2025

1. AI investments driving more secure and predictive operations

What middle market leaders are saying

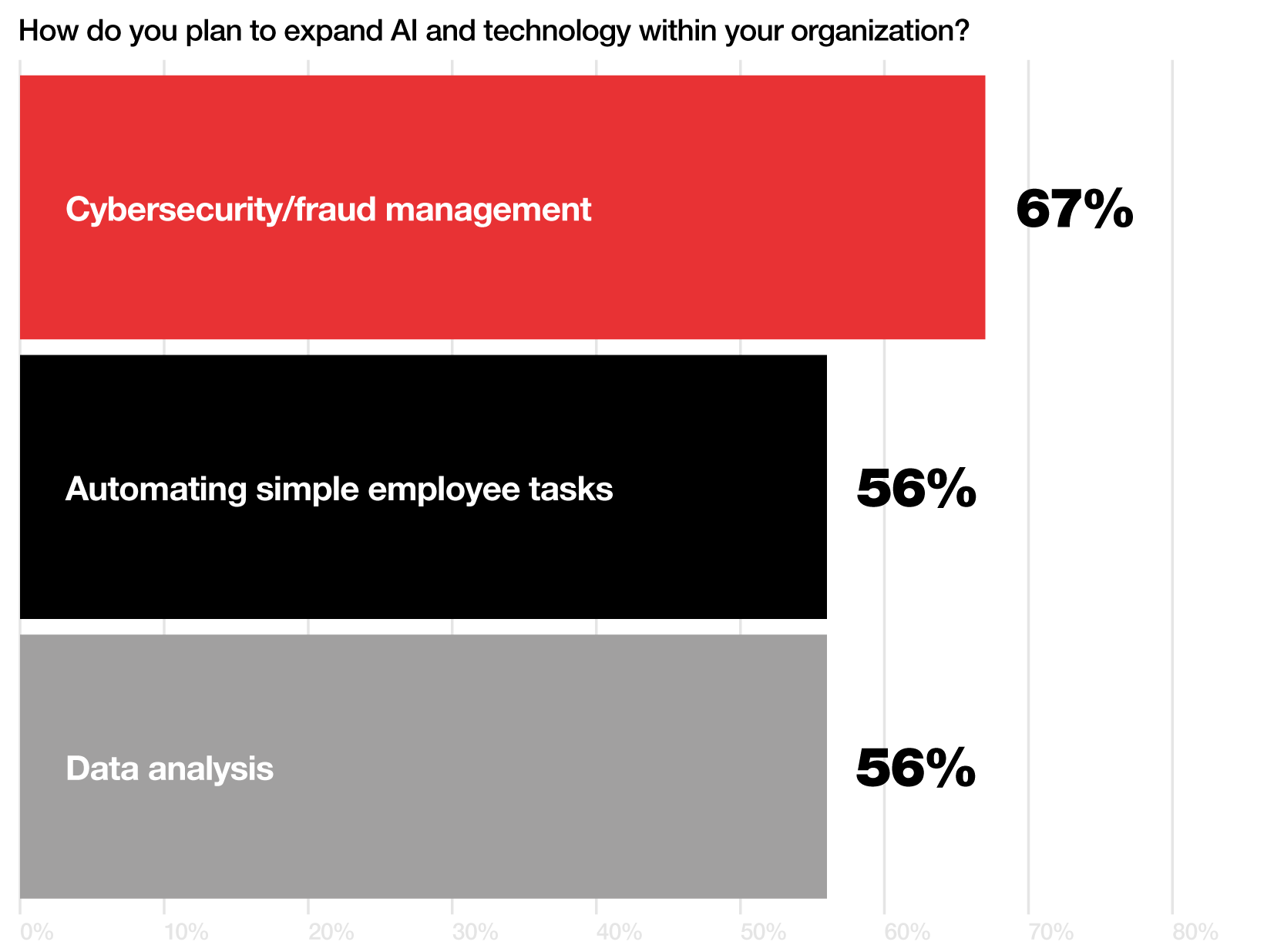

Middle market leaders are making deliberate, results-oriented AI investments focused on solving real business challenges and driving value. Currently, 67% are directing AI dollars toward cybersecurity and fraud mitigation, while 56% are automating routine tasks and improving data analysis.

GRAPH 1 – How do you plan to expand AI and technology within your organization?

Cybersecurity/fraud management 67%

Automating simple employee tasks 56%

Data analysis 56%

What it means for you

Now is the time to rethink how work gets done. AI isn’t just about automating tasks. It’s about building a business that scales securely, adapts quickly, and empowers teams to focus on growth.

Technology adoption doesn’t have to be complex. Start with what slows you down. Streamline workflows. Speed up decisions. Use data to anticipate what’s next. Better forecasting means faster response times, which matters in an economic environment where expectations continue to rise even when headcounts don’t.

The best AI projects are relatively simple, start small, and scale fast: Secure the payments rails, streamline a repetitive workflow, prove the efficiency, then reinvest. That rinse-and-repeat cycle is how middle market companies outpace larger rivals without outspending them.

Brandon Nowac

Commercial Executive, KeyBank Commercial

2. Productivity leads anticipated benefit of AI

What middle market leaders are saying

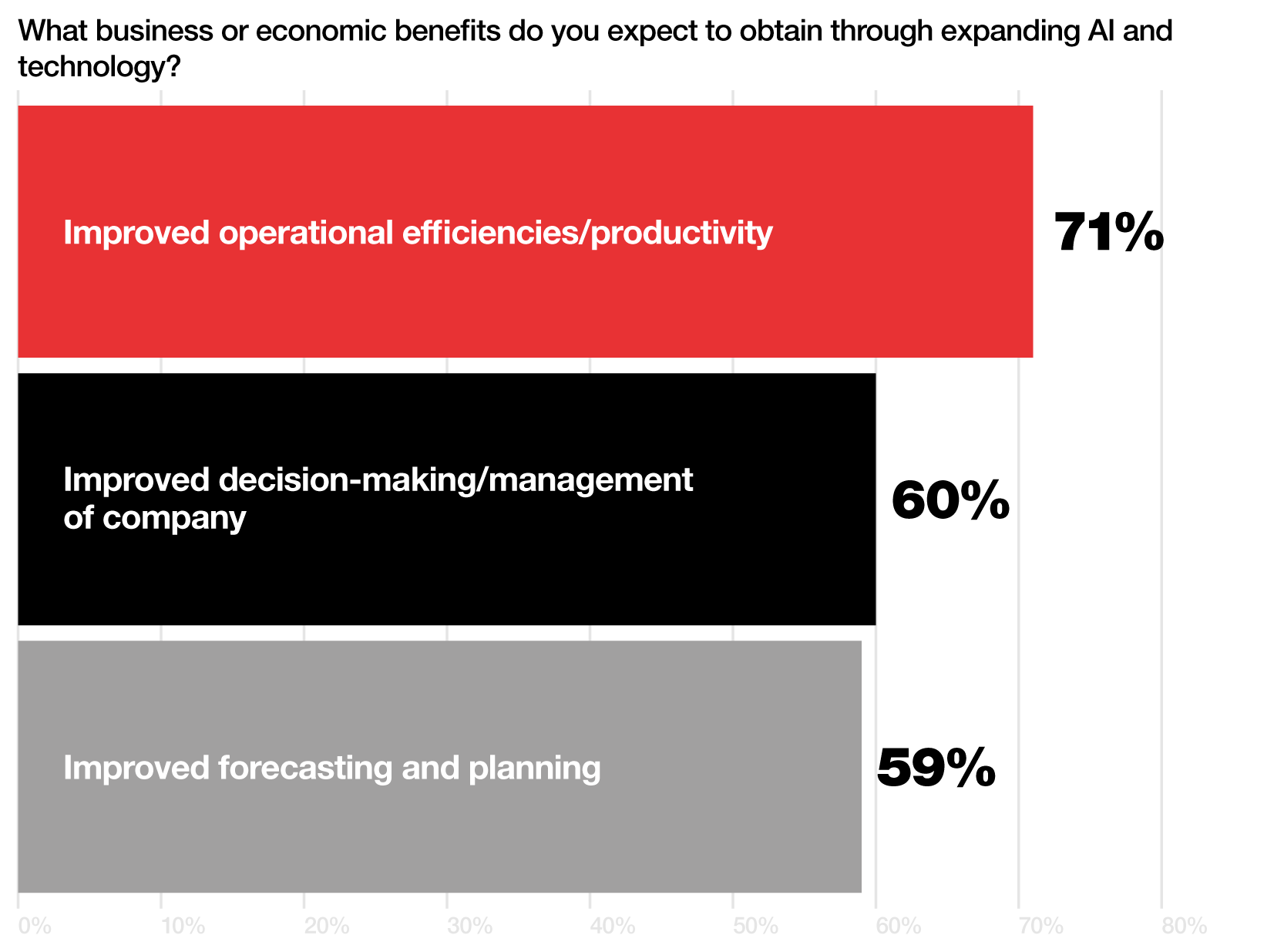

Middle market leaders are realizing tangible benefits from AI and technology, with gains in productivity, forecasting, and data-driven decision-making. The most anticipated outcome is greater operational efficiency, followed closely by improved decisions and enhanced planning.

GRAPH 2 – What business or economic benefits do you expect to obtain through expanding AI and technology?

Improved operational efficiencies/productivity 71%

Improved decision-making/management of company 60%

Improved forecasting and planning 59%

What it means for you

It’s a big decision to invest in AI, especially with questions around ROI and implementation. But the payoff is real. Reducing manual tasks frees up your team for strategic work. Easier access to data speeds up decisions. And accurate forecasting helps protect margins and drive growth.

Teams can reclaim time, reduce errors, and make more effective moves with technology that supports AI. Whether automating reports or improving planning, the benefits show up in your growth and your team’s ability to focus on profitability.

3. Data privacy and integration are top technical hurdles

What middle market leaders are saying

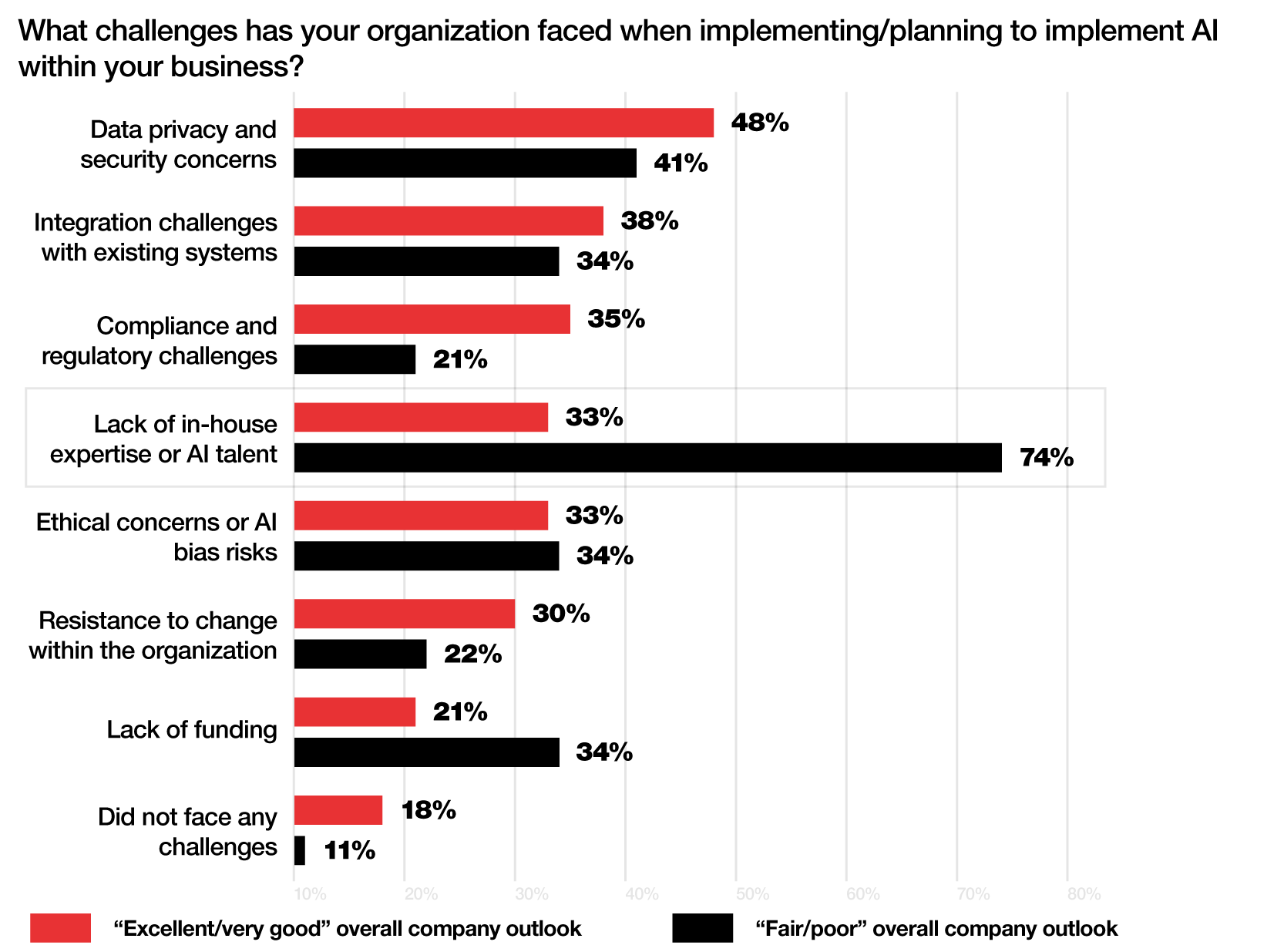

Among firms with a strong business outlook, nearly half of executives cite data privacy and security concerns as their top AI challenge, followed by 38% who face integration issues and 35% who struggle with legacy system compliance.

For middle market companies with a fair or poor outlook, the challenges are even more pronounced. A lack of in-house AI expertise is reported by 74%, which is more than double the rate among confident firms (33%). While funding and change management are secondary concerns, they remain significant.

GRAPH 3 – What challenges has your organization faced when implementing/planning to implement AI within your business?

Base: “Excellent/very good” overall company outlook

Data privacy and security concerns 48%

Integration challenges with existing systems 38%

Compliance and regulatory challenges 35%

Lack of in-house expertise or AI talent 33%

Ethical concerns or AI bias risks 33%

Resistance to change within the organization 30%

Lack of funding 21%

Did not face any challenges 18%

Base: "Fair/poor” overall company outlook

Data privacy and security concerns 41%

Integration challenges with existing systems 34%

Compliance and regulatory challenges 21%

Lack of in-house expertise or AI talent 74%

Ethical concerns or AI bias risks 34%

Resistance to change within the organization 22%

Lack of funding 34%

Did not face any challenges 11%

What it means for you

To get the most value from AI, start with a strong foundation. Embed privacy and security into your design from the outset and choose tools that integrate smoothly and meet compliance standards. A breach or misstep can stall progress before it starts.

Talent is also critical. Without the right skills, even the best AI strategy falters. Upskill internal teams or bring in external expertise to accelerate progress. Delaying AI adoption due to budget constraints or internal resistance puts you at risk of falling behind competitors who are already gaining efficiency and insight. Combine smart investment with strong change management to ensure adoption — so AI delivers impact, not shelfware.

Final thoughts

Leaders are moving beyond pilot programs to scalable solutions that deliver measurable impact. The trends show a clear shift: Companies are investing with purpose, aligning technology to business outcomes, and building resilience through efficient operations. As the pace of innovation accelerates, those who act now will be best positioned to lead.

KeyBank recognizes the challenges of today’s economic landscape and the concerns it creates for business leaders. Our middle market experts bring experience and vision from leaders who are leveraging AI, capital discipline, and cyber resilience to position their companies for growth and potential M&A activity. We deliver strategic insights, personalized financial solutions, and timely guidance to help you manage uncertainty, unlock growth potential, and translate your vision into measurable outcomes.

Ready to turn knowledge into results? Download the full July 2025 Middle Market Sentiment Report for the data, charts, and executive perspectives you need to drive productivity and strengthen operations.