All energy on deck: Powering the future of data centers

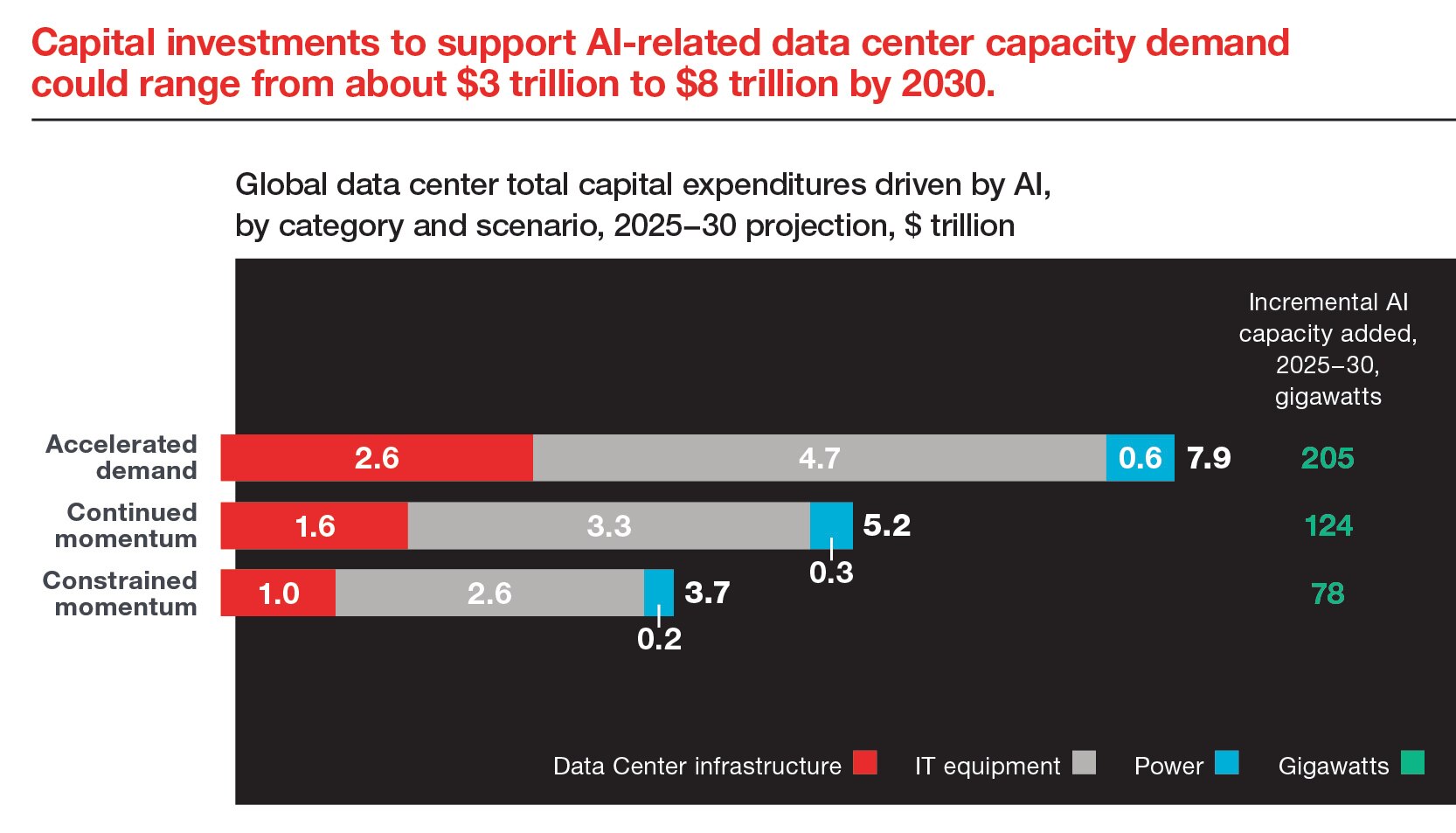

Artificial intelligence is driving explosive growth in data center demand. In contrast to conventional computing, AI is power hungry and has evolved from being a valuable infrastructure element to an essential resource. Goldman Sachs projects global power demand from data centers will increase 165% by 2030, and McKinsey puts a stunning $7 trillion price tag on the cost of investment needed by decade’s end.

As AI adoption accelerates and companies race for more power, governments, utilities, and private sectors face a simple reality: meeting this demand requires both renewable and traditional energy. For investors, this translates into making strategic capital decisions and being aware of shifting policies that will impact long-term returns.

GRAPH 1 – Capital investments to support AI-related data center capacity demand could range from about $3 trillion to $8 trillion by 2030.

*Global data center total capital expenditures driven by AI, by category and scenario, 2025-30, project, $ trillion

Accelerated demand

Data Center infrastructure – 2.6

IT equipment – 4.7

Power – 0.6

Total – 7.9

Gigawatts - 205

Continued momentum

Data Center infrastructure – 1.6

IT equipment – 3.3

Power – 0.3

Total – 5.2

Gigawatts - 124

Constrained momentum

Data Center infrastructure – 1.0

IT equipment – 2.6

Power – 0.2

Total – 3.7

Gigawatts - 78

Source: McKinsey Quarterly, The cost of compute, April 2025

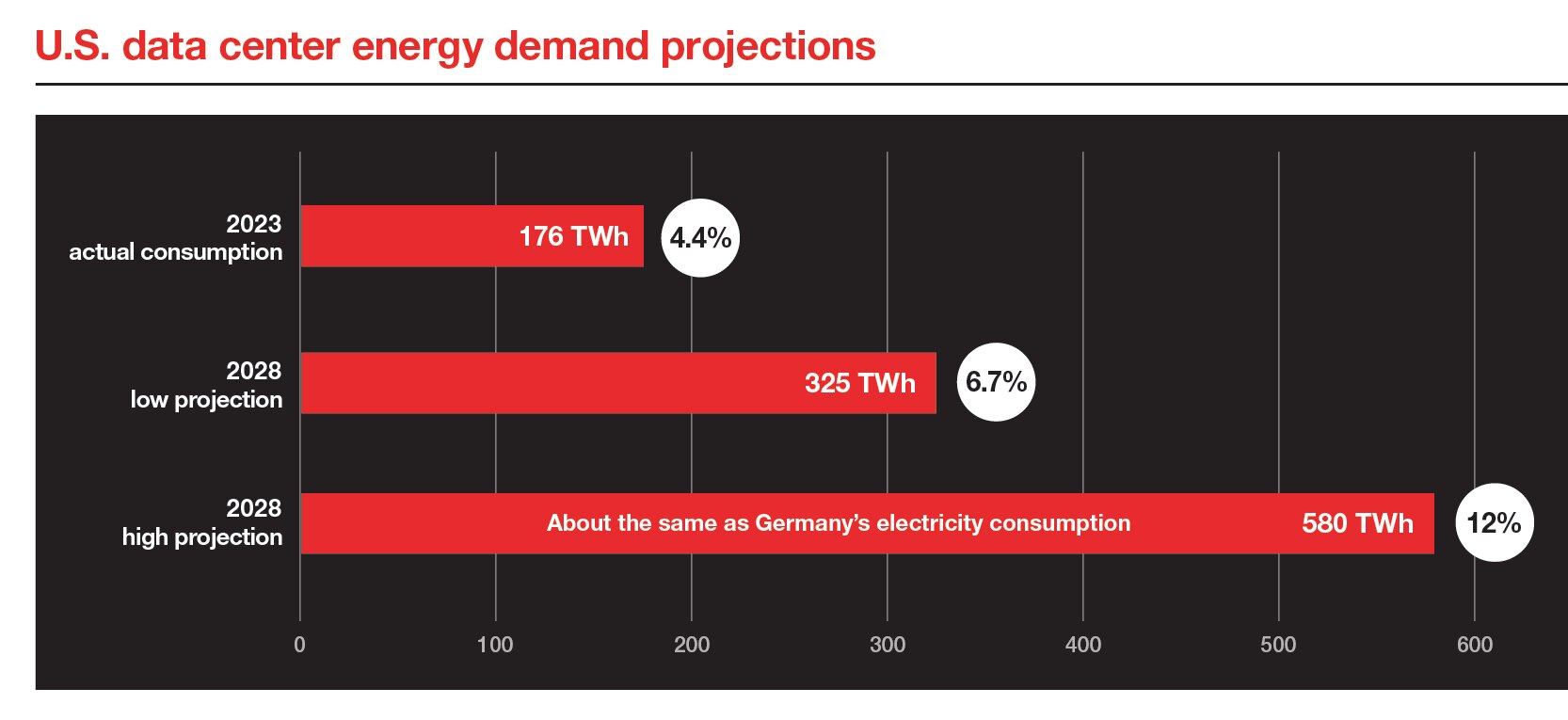

GRAPH 2 – U.S. data center energy demand projects

2023 actual consumption – 176TWh (4.4%)

2028 low projection – 325 TWh (6.7%)

2028 high projection – 580 TWh (12%)

*About the same as Germany’s electricity consumption

Given broader trends of electricity demand growth and limited opportunities for cannibalization, the U.S. would need to add ~250 TWh in generation to address forecasted data center demand growth by the end of the decade.

Sophie Karp, Managing Director, Senior Equity Analyst, Electric Utilities & Alternative Energy, KeyBanc Capital Markets

Today, the U.S. patchwork of electrical grids can support current data center energy demand but future hyperscaler loads will quickly strain capacity. The U.S. is investing in solar and wind, but their intermittency and transmission challenges mean they cannot carry the load alone. Nuclear, hydro, and natural gas have emerged as critical stabilizers. Pairing nuclear energy with renewables could reduce generation and transmission costs by around 37%, according to the Department of Energy.3

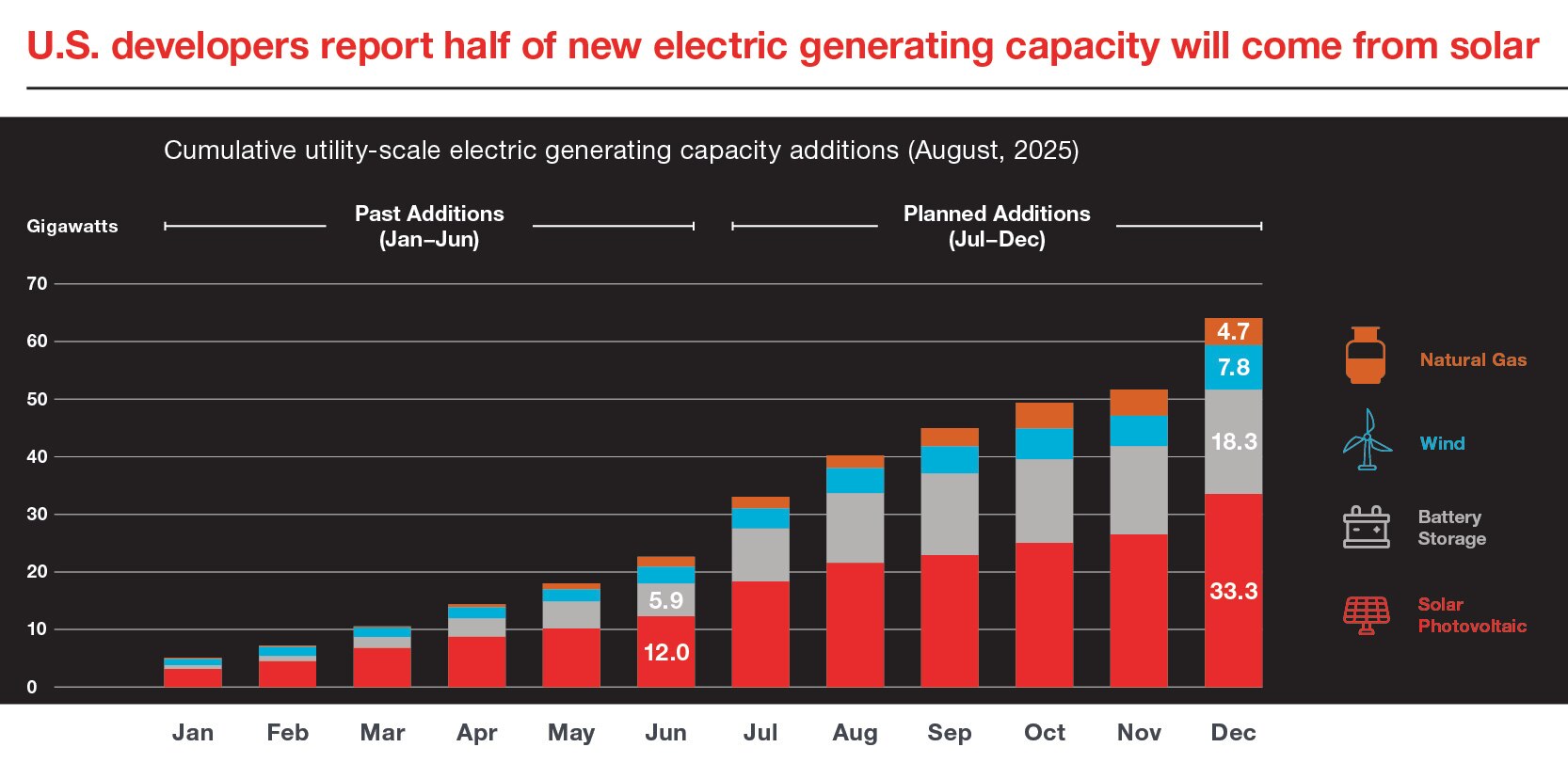

The dominance of solar is a concern since it is an intermittent resource with a lower capacity factor. Ultimately, it is up to grid operators and policymakers to ensure grid reliability as new generation sources come online.

Andy Redinger, Managing Director and Head of Utilities, Power and Renewable Energy M&A, KeyBanc Capital Markets

GRAPH 3 – U.S. developers report half of new electric generating capacity will come from solar

Cumulative utility-scale electric generating capacity additions (August, 2025)

*Measured in Gigawatts

**Past Additions (Jan-Jun)

***Planned Additions (July-Dec)

June

· Battery Storage – 5.9

· Solar Photovoltaic – 12.0

December

· Natural Gas – 4.7

· Wind – 7.8

· Battery Storage – 18.3

Solar Photovoltaic – 33.3

Source: U.S. Energy Information Administration, Today in Energy In-brief Analysis, August 2025

Major tech leaders are already taking action for a diversified grid. Many are pairing solar and wind farm investments with nuclear or natural gas agreements to generate enough power to ensure 24/7 uptime.

Policy and infrastructure: The critical link

The shift to using diversified sources of power requires legislators to balance near-term energy demand with long-term decarbonization goals, while also creating a more interconnected grid.

Easily accessible power sources and ready interconnection sites are being used up quickly. Policymakers at every level must respond to this new reality.

Sophie Karp, Managing Director, Senior Equity Analyst, Electric Utilities & Alternative Energy, KeyBanc Capital Markets

While the reconciliation bill preserved energy tax credits for battery storage, hydro, geothermal, carbon capture, and clean fuels, it shortened the timeline for solar and wind production tax credits and investment tax credits (PTC and ITC). Analysts warn this rollback could eliminate up to 340GW of power generation by 2035, raise wholesale electricity by 25% by 2030, and by as much as 74 percent by 2035.4

Policymakers are weighting fairness to residential customers, who typically pay higher energy rates, and risk stranded assets built to support data centers should the trend shift. Increased demand could result in 8% higher electrical bills nationally, with some regions exceeding 25%.5 Some states are in the “study phase,” but Wisconsin and Michigan have taken action. Wisconsin’s WEC Energy Group filed a proposal for The Very Large Customer tariff to ensure large energy users, like data centers, pay their fair share of electrical rates. The Michigan Public Service Commission has made a similar effort to revise the rate category for large-load users. These are early signals of the regulatory frameworks that could spread nationwide.

Infrastructure takes time to build

A legislative response is one challenge, but more fundamentally, it simply takes time, capital, and labor to build these resources:

- Solar power is the fastest to market, taking approximately two years to complete a solar farm.

- Gas power takes three to four years.

- Wind power takes approximately five years.

- Nuclear power requires the most amount of time, with 10+ years.

We expect coal retirements to proceed on schedule, but the timeframe for constructing nuclear reactors means renewables will continue to lead capacity additions in the near- to mid-term, as they offer fastest to market option.

Andy Redinger, Managing Director and Head of Utilities, Power and Renewable Energy M&A, KeyBanc Capital Markets

Karp adds that supply chain, labor challenges, and the increasing demand for natural gas generation has also extended new construction timelines of five to seven years for new builds — a significant barrier to new energy construction.

Geography will drive the next wave of power development

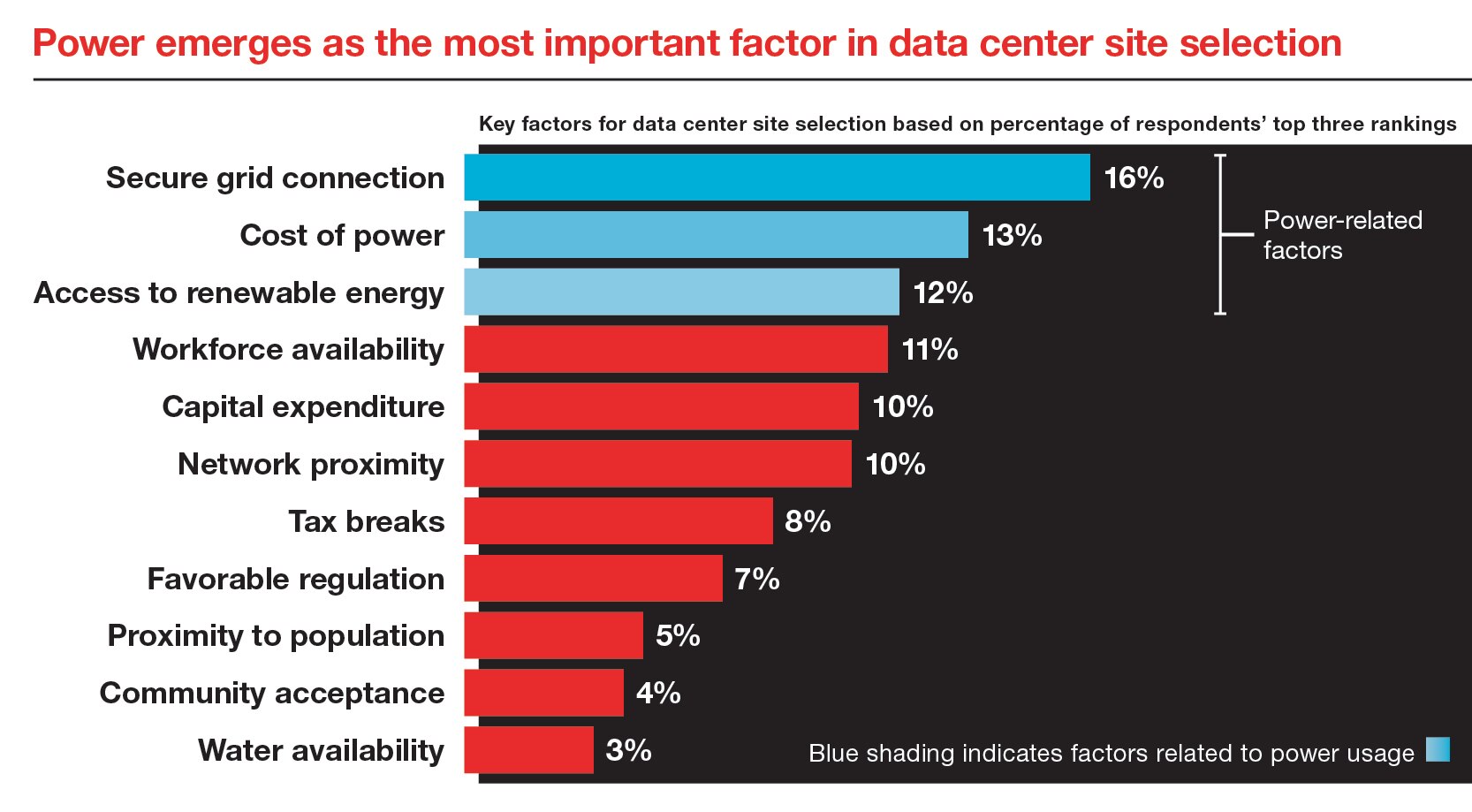

According to BloombergNEF, power availability will become the number one factor in data center site selection. Data center operators look for differences in power prices, availability of fiber infrastructure, and time to market.

GRAPH 4 – Power emerges as the most important factor in data center site selection

*Key factors for data center site selection based on percentage of respondents’ top rankings

**Power-related factors

Secure grid connection – 16%

Cost of power – 13%

Access to renewable energy – 12%

**Power-related factors

Workforce availability – 11%

Capital expenditure – 10%

Network proximity – 10%

Tax breaks – 8%

Favorable regulation – 7%

Proximity to population – 5%

Community acceptance – 4%

Water availability – 3%

Source: Data Center Dynamics, Vertiv, BloombergNEF.

KeyBanc Capital Markets created a scorecard to measure these metrics and found the Midwest and parts of the Pacific Northwest region offered the best resources for prospective hyperscaler and data center development and investment.

After decades of decline, these regions now have excess infrastructure capacity both from generation and grid interconnect standpoints, enabling large new loads with attractive time-to-market. They also boast below-average power prices, relatively cheap land, and cooler climates with reliable access to water.

Sophie Karp, Managing Director, Senior Equity Analyst, Electric Utilities & Alternative Energy, KeyBanc Capital Markets

All of these elements are imperative when selecting the right location for new data center development and ensuring the location has the resources needed to provide adequate power.

The path forward: Balance and investment

For data centers, the AI technology they enable, and the emerging technologies yet to come, the future will not be powered by renewables, nor by fossil fuels, alone. It requires a diverse, resilient energy portfolio supported by a collaboration from:

- Both renewable and traditional energy sources.

- Public and private sector collaboration.

- Smarter grid interconnection.

- Long-term infrastructure planning.

Industry expertise at KeyBanc Capital Markets

AI continues to develop rapidly, continuously reshaping opportunities and altering valuations and strategic capital deployment. As a leading lender and advisor in the renewable energy market for more than two decades, KeyBanc Capital Markets is positioned to help build what the future needs. Energy is a capital-intensive industry that is complex and vital. Our expertise in financing delivers diverse solutions, best-in-class investment banking, and innovative capital markets.

Learn more about our industry-leading renewable energy practice

To speak to an expert, contact Andy Redinger, Head of Utilities, Power and Renewable Energy M&A, KeyBanc Capital Markets

Explore our recent deals and visit key.com/energy to discover how we can help you stay ahead of energy trends.